I have been receiving email enquiries about diamond investing at a record level and I’ll gladly share my thoughts and recommendations for you to make an informed decision when considering diamonds as an investment. I promise to be as objective as possible.

It’s no secret that financial markets across the globe are fragile and tumultuous.

Millions of investors are turning to asset classes other than government bonds, cash and stocks. Rather opting for cryptocurrency, but also hard assets like gold and land.

Rumours are rife that some large banks are investing in diamonds. I can’t commit to naming any institutions but I think it warrants a discussion.

Many folks abandon their research into diamond investing when they run into three main issues:

What’s a good price to pay for specific diamonds?

Where do I buy and sell said diamonds?

Where can I find non-salesy advice?

Disclaimer: I am not a financial advisor in any capacity and this information is merely my opinion and not investment advice in any shape or form.

1. Natural Vs Lab-Grown Diamonds

Diamonds have been synthesized, grown and created in laboratories for many years now. Although the broader diamond industry saw it as a threat 20 years ago, the price of naturally mined diamonds has been seemingly unaffected.

It’s important to keep in mind that the number of natural diamonds is finite. The low hanging fruits have been picked and diamond mining is becoming increasingly expensive as deposits are harder and harder to reach.

On the other hand, an infinite amount of diamonds can be created in a laboratory. As technology improves, the cost of production decreases, and so do the selling prices of these lab-grown diamonds.

It’s undeniable that natural diamonds have a sense of sentimental romanticism to them that lab-grown diamonds lack.

My arguments for, and against, diamond investing will be solely applicable to natural diamonds.

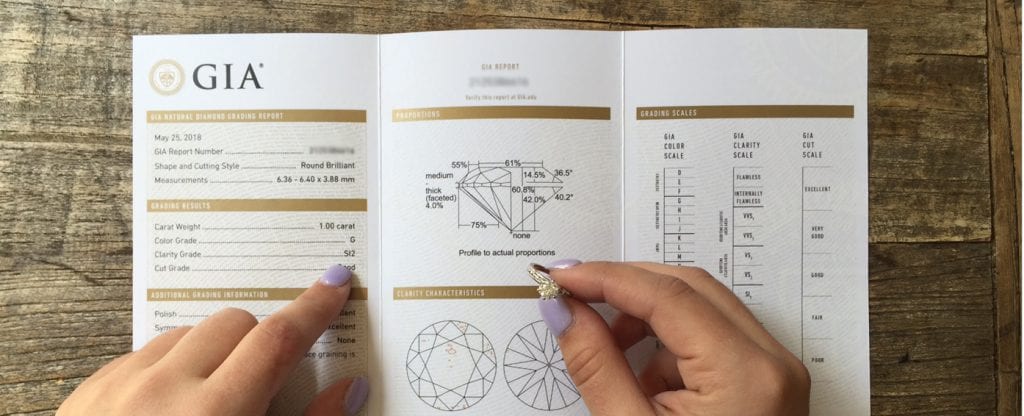

2. Certification Matters.

You need certainty about the details and specifications of the diamond you’re investing in.

That’s where top-tier independent, reputable and accurate grading reports come into play to verify;

- The origin of a diamond. Whether the diamond was lab-made or naturally occurring, should be prominently and descriptively stated on the grading report.

- The specifications of a diamond including carat, carat, colour, clarity etc. The price of a diamond is calculated on the graded specifications, so you need these specifications 100% on point.

The global leader in third-party diamond certification is the Gemological Institute of America – GIA.

Their standards are high, accurate, consistent and more importantly – trusted by the global diamond trade.

3. Price

I’d guess the main deterrent from diamond investing is making sense of the pricing.

Unlike most commodities and publicly traded shares, diamonds don’t have a readily available transparent, open-market price you can verify on a platform such as Bloomberg or Reuters.

Simply taking into account 4 important specification fields (shape, colour, clarity, fluorescence) you have over 100 000 possible combinations, each with a unique price based on the individual combination of specifications.

Prices also differ widely between vendors for the exact same diamond;

- Their cost prices differ.

- Profit margins differ widely from one vendor to the next.

These issues can make price research complicated, but not impossible. You need to find an uncompromised diamond at a great price relative to the asking prices you find in the market.

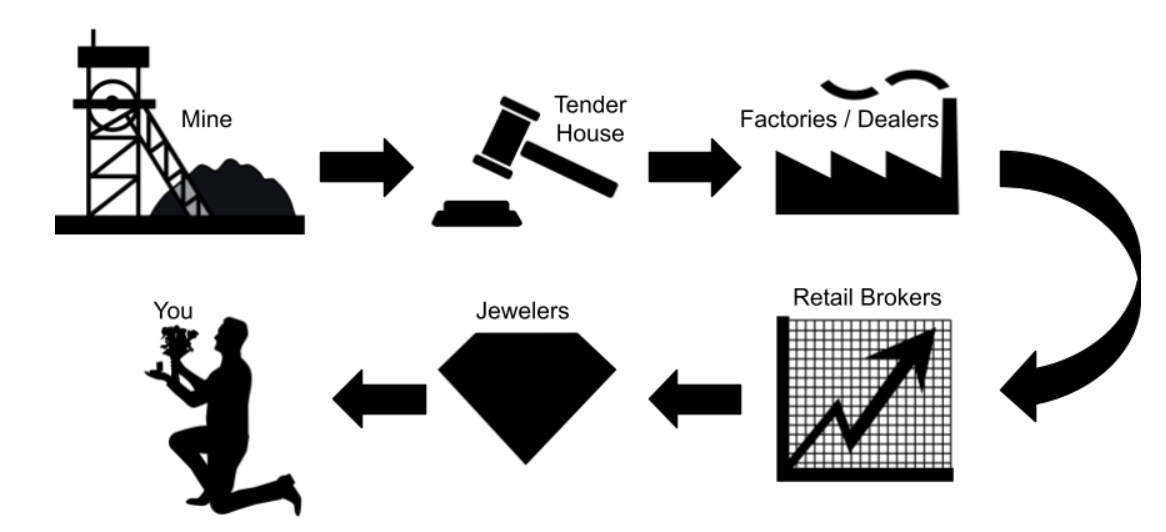

It’s key to understand the diamond value and supply chain.

Diamonds exchange owners, each taking a profit, multiple times before showing up in a public display somewhere.

The price of a diamond can very easily triple as it moves down the value chain into the stock of a jeweller or diamond dealer.

The basic supply chain from a diamond mine to your safe is quite long: (can be much longer too).

It seems logical that the closer you get to the source (mine) the less you’ll pay.

That’s not always the case.

A lot of diamond vendors will try to convince you that they’re way closer to the source than they indeed are. There’s always a middleman and the concept of “diamonds at wholesale prices” is very ambiguous.

While researching for this article I gathered prices from a few sources for a 1,00ct J Colour, VS2 round diamond:

- Vendor 1: R73 000

- Vendor 2: R112 000

- Vendor 3: R83 000

- Vendor 4: R84 000

- AVERAGE Price: R88 000

The specifications of the diamond quoted are identical. They’re also all graded by the GIA to ensure we’re comparing apples to apples.

Vendor 1 should be the front-runner, but as you’ll see asking price isn’t the sole issue that should be considered though. Many vendors have added benefits that can justify you paying a small premium for the diamond.

It is a red light if a diamond dealer or jeweller’s only claim to fame is just being cheap. There are probably reasons for that.

Averaging out the quotes you received will give you a much better feel for a going rate, and help you identify a good deal relative to the market.

Although we have never spammed the “wholesale” word we source all our diamonds directly from the largest factories in the world. They have exclusive contracts with mines which in turn actually eliminates the “Tender” and some other middlemen.

Our profit margins are also much slimmer than the rest of the market. It’s not uncommon to find a high-end diamond at a 40% + discount to the market prices. We prefer selling higher volumes at lower profit margins. You can see our latest specials here.

4. Recommend Diamond Specifications for Investment Purposes

When the time or need arises, you need to be able to sell your diamond in a reasonable timeframe at a fair price.

The right specifications (According to that GIA certificate we discussed) will give you the best shot at a variety of offers from jewellers, diamond dealers and other interested parties.

If you’re trying to sell a diamond with downright weird and unpopular specifications you’ll have few to no offers from buyers. Since jewellers might be stuck for a long time with the less than ideal diamond they buy from you, offers might be uncomfortably low. They’re not by default taking advantage of you.

To learn more about the 4 main characteristics and specifications of a diamond (The 4C’s) you can head over to this post.

My comments and recommendations within the 4C-model;

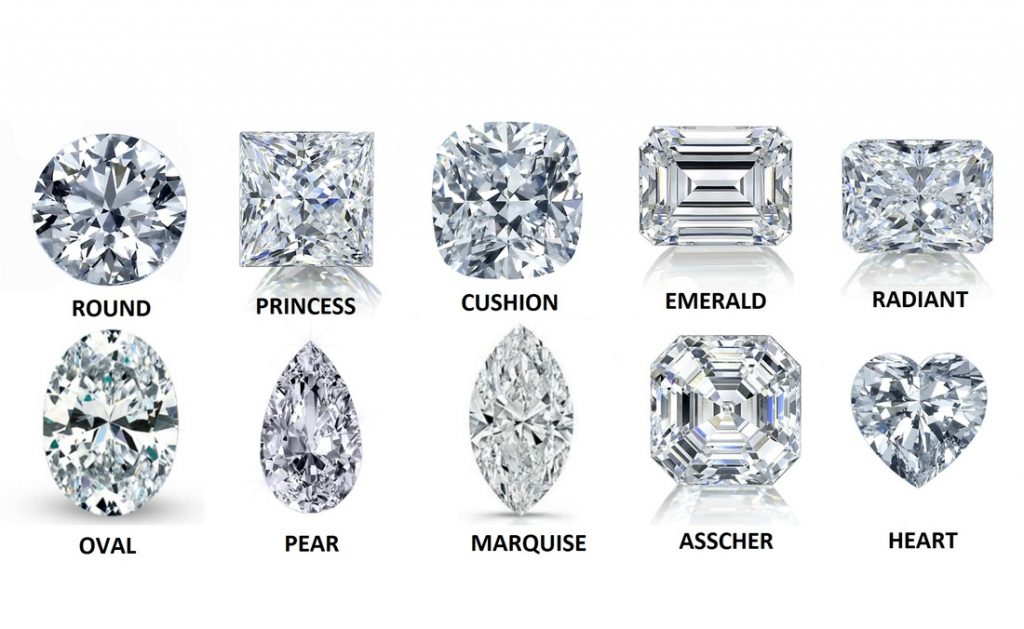

Shape

Round diamonds are always in demand and the safest bet.

Shapes like ovals and cushions are currently popular, but demand fluctuates with trends.

Clarity: The purity of the diamond

Close to all diamond buyers and shoppers prefer a diamond to be free from inclusions and impurities visible to the naked eye. Keep the clarity to VS2 and higher if possible, and make sure to take a good look at the diamond before you pull the trigger.

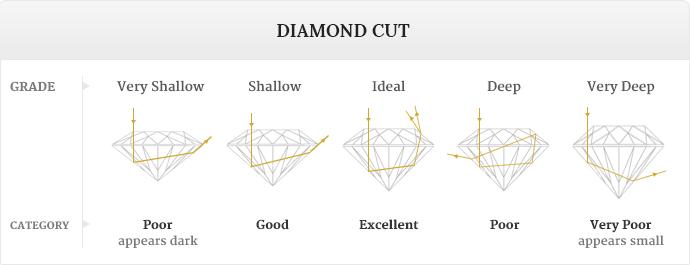

Cut-Grade:

Cut refers to how well a diamond was cut and polished from its rough origin to the beautifully finished gemstone. Every facet and angle needs to be made to predetermined angles and ratios to ensure optimal light reflection and refraction.

If a diamond was poorly cut it looks like a dull piece of glass. Not. Nice.

Round diamonds have cut grades of Excellent, Very Good, Good, Fair and Poor.

Stick to Excellent and Very Good cut grades.

Personally, I think that Cut-grade is the most important characteristic. You can head over here for more information.

Colour

There’s no real right or wrong answer here, but I do think it makes sense to choose a popular and evergreen diamond colour.

Diamond colours are graded by descending alphabet letters with D as completely colourless, and incrementally gaining colour as you move down to Z which appears prominently yellow.

Popular colours that I can recommend would be: F, G, H, I, and J.

They set up white in rings and offer great value to engagement ring shoppers.

*We’ll discuss very unique colours like blue and red in a later section.

Carat (Size)

While keeping the characteristics in the value-specifications (Goldilocks-Zone) explained above you can optimise size to fit your budget.

With diamond specifications staying identical you can work roughly on quadrupling the price as you double the weight of a diamond.

- 0,50ct H VS2-clarity diamond: +/-$1 250.

- 1,00ct H VS2-clarity diamond: +/-$5 500.

Don’t be tempted to drop characteristics too low to focus on size alone. A good quality 0,90ct diamond is a much better investment than a compromised 1,00ct option.

5. Rare Vs. Unfavourable Vs Fad Diamond Specifications

This is a crucial distinction to make when selecting a diamond for investment purposes.

Certain diamonds are hard to come by because their demand is super low and no one sees the value of keeping them in stock. This doesn’t imply that they’re rare in any beneficial way to an investor.

A guy with 3 arms is also rare, but does it really give him an edge in breakdancing? Or is that arm just going to get in the way?

An example of unfavourable specifications would be a 1,00ct diamond that’s D-colour (Colourless) but with a chubby black spot right in the middle of the stone. The high colour can’t save the dismal clarity.

Fad diamonds are scarce due to their high popularity for a relatively short period of time. Prices will peak for a few months, and then the demand and prices drop relatively quickly.

A couple of years ago jewellers rebranded brown diamonds as “cognac” and “champagne” colour… but once the craze died down they’re just back to being; brown diamonds. They’re still beautiful. The lack of demand has just crashed the high prices seen a few years ago.

Currently, “Salt and Pepper” diamonds are popular. Sure, the splatter of small black inclusions might be interesting at first sight, but these diamonds often have so many impurities and inclusions that their crystal structure is compromised. This can cause cracking and chipping of the diamond.

Also not a good investment.

Truly valuable rare diamonds on the other hand do have a demand from select collectors paired with a very limited supply of newly mined special diamonds. Very scarce colours like red and blue diamonds fall into this category. In May 2016 a 14,62ct fancy vivid blue diamond sold for $57 500 000 at a Christie’s auction in Geneva. It’s a niche market, to say the least.

Unfavourable specifications, fad and rare colour diamonds are all hard to sell due to a severely limited market or lack of access to wealthy coloured diamond collectors. Don’t bet on the right buyer coming along in a few years’ time.

6. Choosing a Vendor or Supplier

The most expensive source to buy a diamond from is a traditional mall-based jeweller.

Operating and funding a mall-based jewellery business is excruciatingly expensive. The rent alone on prime locations in a mall can easily run into the hundreds of thousands (Rand per month).

Covid-19 has not been kind to jewellers, with a lot of people feeling hesitant to try on rings that have been touched by many hands and might not have been sterilised afterwards.

Take note of how alarmingly empty these stores are these days.

These factors have forced mall-based jewellers to increase margins to ensure that costs can be covered with the lower volume of sales. Or they have to close shop as many jewellery stores have.

You’re in the fortunate position to have quite a few reputable diamond dealers and jewellers to buy a diamond from in South Africa. Do your homework when looking for a vendor. Scrutinise online reviews and testimonials.

Knowing a supplier has a reputation on the line will give you added peace of mind.

When it comes to investing in loose diamonds – give mall jewellers a skip.

7. Investment Upgrade Possibilities

I mentioned earlier that your diamond investment shouldn’t be based solely on price.

All our diamond sales include a 100% upgrade policy. Whenever you wish to upgrade your diamond investment, you will get full credit for your initial purchase and simply pay in the difference.

This enables you to invest in higher-end and higher quality as you grow your diamond investment portfolio.

So, you can start big… or small.

Pretty neat.

*Look out for small print in similar “grow your diamond” plans. Many require you to at least double your initial investment.

8. Expectation Of Returns & Yield

Although diamonds have historically been a good and stable store of money, very few players in the diamond industry are of the opinion that unparalleled growth in diamond prices is in the near future.

Paying too much initially will also mean that you need many years of growth in diamond prices to be able to merely sell the diamond back to a diamond dealer for the price you paid.

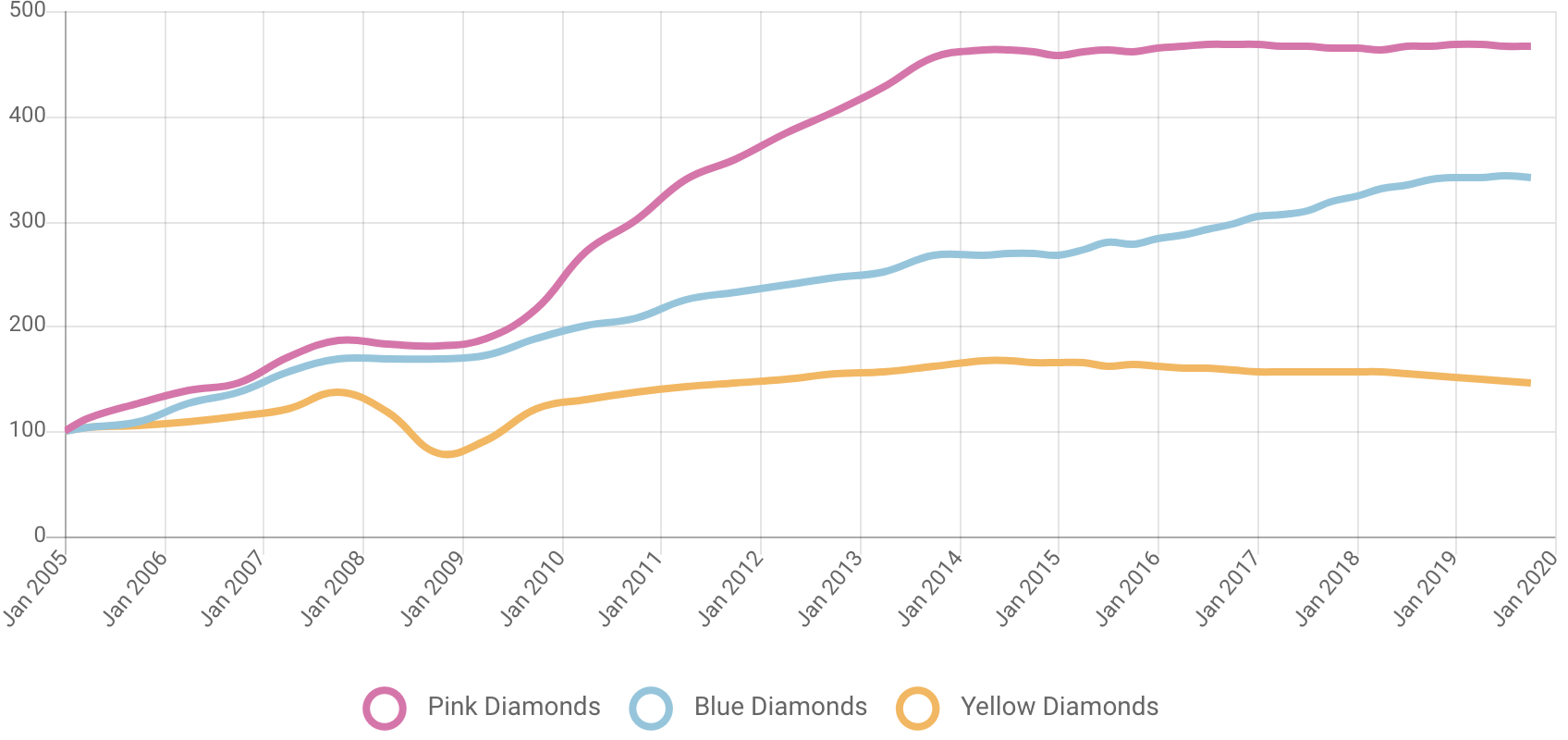

The following chart shows examples of 15-year yields on rare coloured diamonds:

Although the 380% return on the price of pink diamonds over 15 years seems to be high, it’s just an 11% annualised return.

And as you can see from the graph above, pink diamonds were the best performing class of diamonds.

Keep in mind coloured diamonds appreciate more than your run-of-the-mill diamonds as discussed in this post.

Don’t expect tenfold returns in a year or two.

9. Know Advice From Sales-Talk

Finding objective advice and guidance on diamond investing can be difficult. Jewellers and diamond dealers will understandably try to convince you to buy a diamond they have in stock. What they have in stock might not be a bullseye investment diamond.

Be vigilant for sales talk that someone tries to package as “investment advice”.

We always have a massive selection of diamonds available and I’ll gladly help you find the perfect fit whether it’s for investment purposes or an engagement ring.

I did my best to ensure that this post is as objective and actionable as possible, without bias. Whether you decide to buy a diamond from us or elsewhere, I want you to get a good deal.

View our latest diamond specials HERE.

I’d love to get your feedback on this post!

Any questions? I’m an email away: johan@poggenpoel.com

Johan Poggenpoel

Poggenpoel Diamond Jewellers Co-Founder